India Market Wrap-Up – Sensex Falls 1,200 Points Amid Global Tensions | 19 Feb 2026

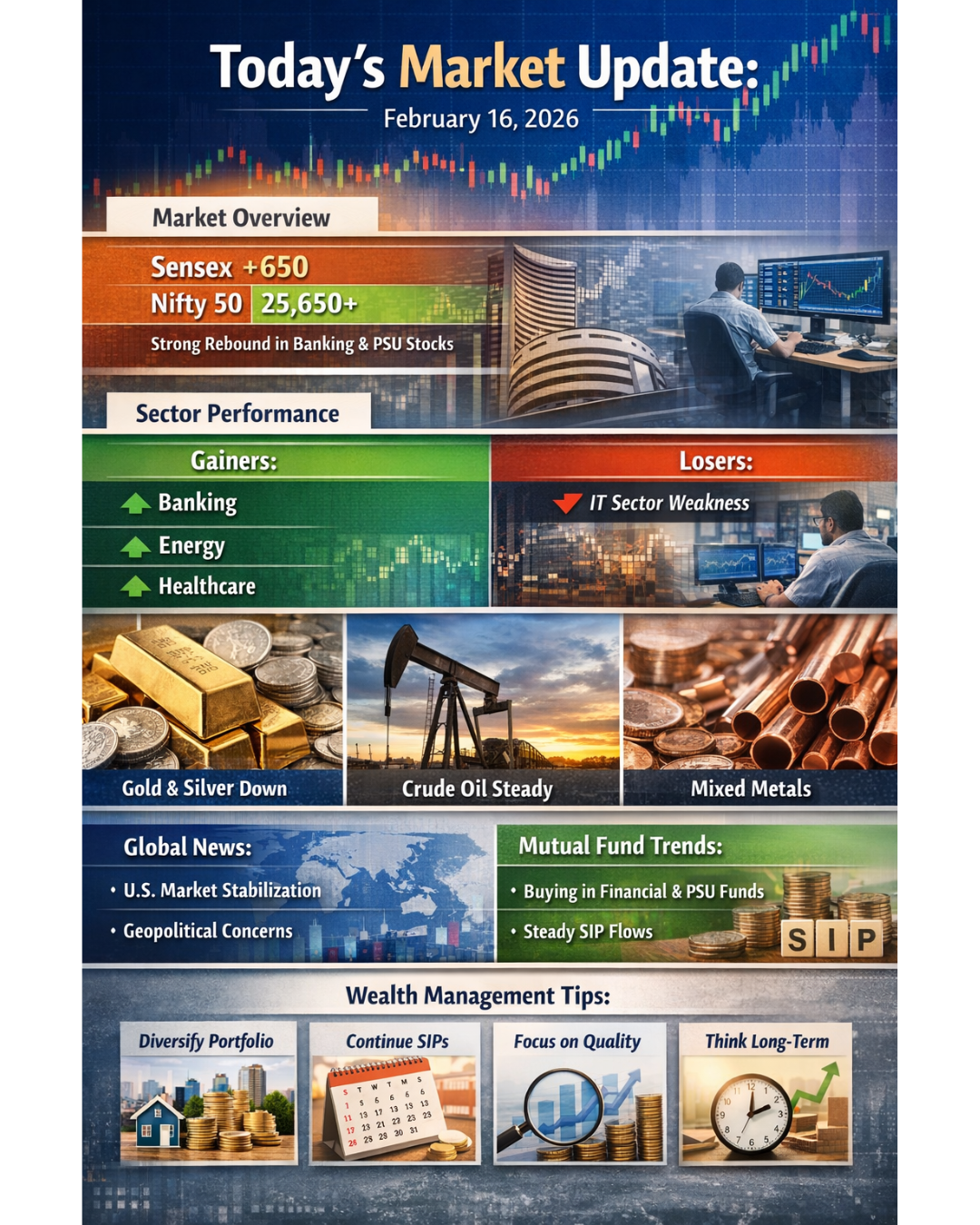

Equity Market Performance

Indian equity markets witnessed a sharp correction today amid global uncertainty and profit-booking across sectors.

- BSE Sensex closed lower by approx. 1,200+ points, ending near 82,498.

- Nifty 50 declined around 350+ points, settling near 25,454.

Market Breadth:

- Majority of sectoral indices ended in red.

- Midcap and Smallcap stocks underperformed benchmarks.

- Investor wealth saw significant erosion during the session.

Key Reasons for Decline:

- Rising global geopolitical tensions impacting risk appetite.

- Spike in crude oil prices creating inflation concerns.

- Profit booking in banking, auto, realty, and capital goods sectors.

- Weak global cues and cautious FII positioning.

Metals & Commodity Movement

Precious Metals:

- Gold & Silver traded firm amid global risk-off sentiment.

- Safe-haven demand supported bullion prices.

Industrial Metals:

- Base metals remained under pressure due to global growth concerns.

- Metal stocks saw selling interest in line with overall market weakness.

Mutual Fund & Investment Update

- No major inflow/outflow data released today.

- Large-cap funds likely impacted due to banking and capital goods correction.

- Volatility may lead to short-term NAV fluctuations, especially in sectoral and midcap funds.

- SIP investors remain advised to stay consistent amid corrections.

India–France Strategic & Economic Developments

- High-level discussions took place between Indian and French leadership.

- French President Emmanuel Macron held talks with Prime Minister Narendra Modi.

- Focus areas included defence cooperation, AI collaboration, technology exchange, and critical minerals partnership.

- France announced initiatives to enhance student mobility and economic cooperation.

These developments strengthen long-term strategic and economic ties between the two nations, potentially supporting trade, technology transfer, and investment flows.

Economy & Policy Signals

- Commerce Minister Piyush Goyal reiterated India’s ambition to become the world’s third-largest economy by FY 2027-28.

- Government continues focus on technology adoption, manufacturing growth, and global trade partnerships.

- Inflation and crude price trends remain key monitoring factors for policymakers and RBI.

Rupee & Broader Sentiment

- Rupee traded cautiously amid global dollar strength.

- FII flows remain volatile; institutional participation will be key for near-term direction.

Overall Market Outlook

Today’s correction appears driven by external global triggers rather than domestic structural weakness.

Short-term volatility may continue due to:

- Global geopolitical developments

- Crude oil movement

- FII activity

However, domestic economic fundamentals and long-term growth outlook remain structurally positive.